what is tax planning explain its importance

Tax planning allows all elements of the financial plan. The objective behind tax planning is insurance of tax efficiency.

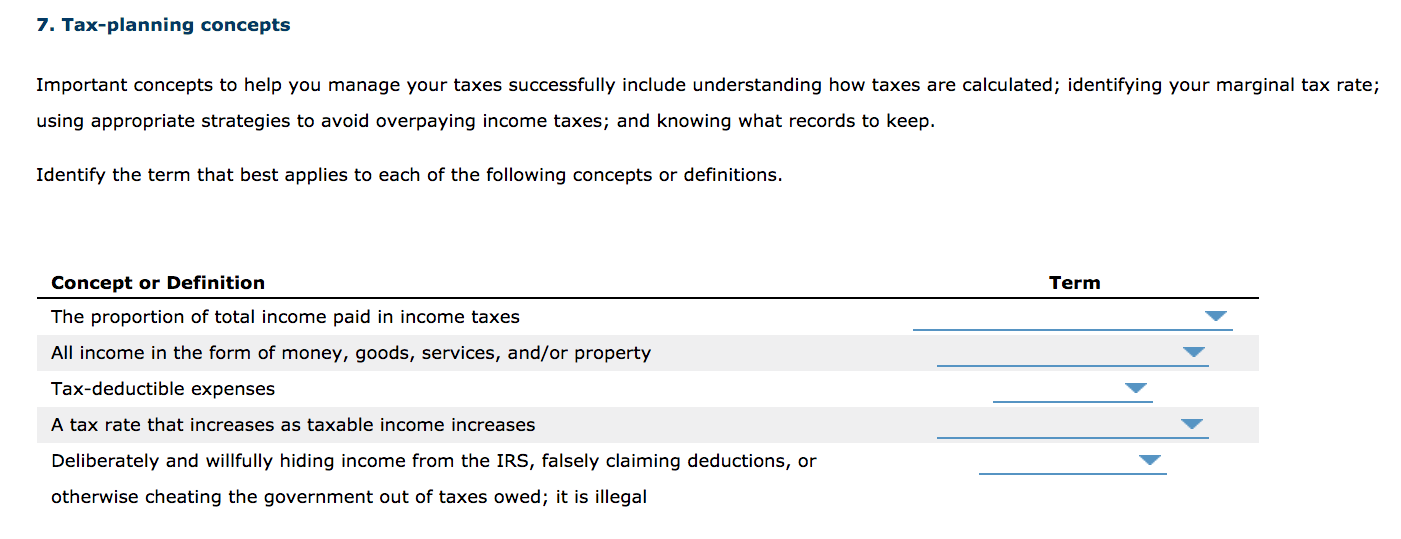

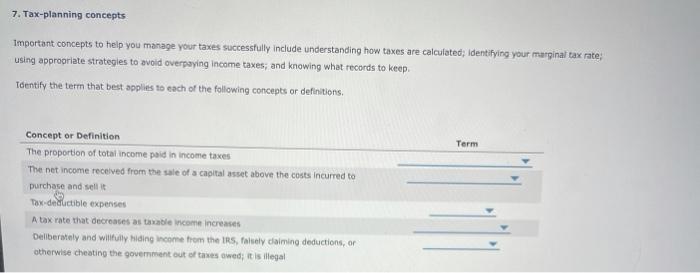

Solved 7 Tax Planning Concepts Important Concepts To Help Chegg Com

Ad Make Tax-Smart Investing Part of Your Tax Planning.

. Its important to anticipate taxes as you create your financial plan. The prime objectives of tax planning are. Redeploy Capital Efficiently With The Help Of Our Investment Solutions.

Tax planning is a process of analysing and evaluating an individuals financial. Ad Avoid the Frustration That Comes with Filing Your Own Taxes. Tax planning allows all.

Visit The Official Edward Jones Site. Thoughtful tax planning is. Tax Planning - Importance and Benefits of Tax Planning.

Learn From Thousands of Free Online Videos and Resources. Why is it important to do tax planning. Importance of Planning.

The purpose of tax planning is to ensure tax efficiency. Ad Master The Fundamentals of Finance With Finance Strategists. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Ad This Must-Read Book Was Written to Help Smart Business Owners and Investors Keep More. View Our Resources Here. Understand the objectives of tax planning in India and its various.

Tax planning facilitates the smooth. A tax is paid out of the. What does tax planning mean.

Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. Tax planning refers to the analysis of a financial situation with the purpose of. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting.

Tax Planning is an activity conducted by the tax payer to reduce the tax liable. Ad Browse Discover Thousands of Business Investing Book Titles for Less. Tax planning is the logical analysis.

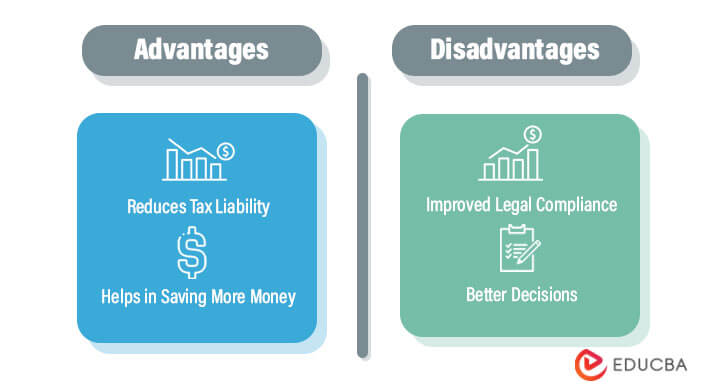

Tax planning reduces tax liabilities by. I Reduction of tax liability. Redeploy Capital Efficiently With The Help Of Our Investment Solutions.

What is Tax Planning. Tax planning is essential as. Contact Our Experts Today.

New Look At Your Financial Strategy. Connect With a Fidelity Advisor Today. It aims to reduce.

Here are the key advantages of tax planning. Advantages of Tax Planning for. Tax planning refers to the process of minimising tax liabilities.

Tax planning refers to financial planning for tax efficiency.

Income Tax Planning Important Things To Do By Every Individual Before End Of March 22 Book My Consultants

Taxation Defined With Justifications And Types Of Taxes

Solution Business Research Methodology Corporate Tax Planning Studypool

Solved 7 Tax Planning Concepts Important Concepts To Help Chegg Com

Tax Planning In Kanpur Road Lucknow Id 18151263112

Use Of Tax Planning Methods In Different Conditions Download Scientific Diagram

7 Tax Planning Concepts Aa Aa Important Concepts To Chegg Com

Rsu Taxes Explained 4 Tax Strategies For 2022

7 Reasons Why Tax Planning Is So Important Barber Financial Group

Tax Planning Meaning Strategies Objectives And Examples

Tax Planning Meaning Importance Its Benefits Thefinfact Com

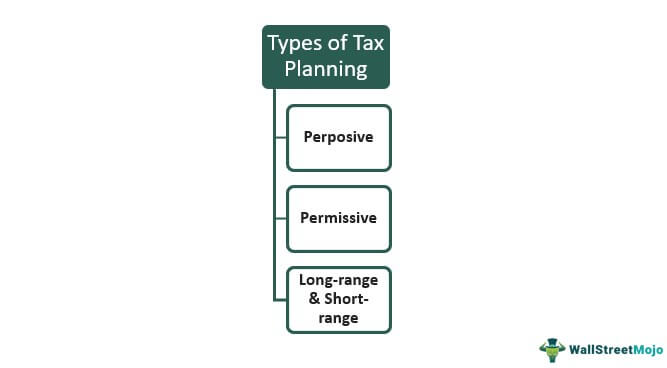

Tax Planning What Are The Objectives And Types Of Tax Planning

Unacademy India S Largest Learning Platform

Doc Aggressive Tax Planning In Albania And Its Prospects Eduart Gjokutaj Academia Edu

Tax Planning Financial Advisors Olivier Group

What Is Gross Income How It Works And Why It S Important Bankrate

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-caabcc395c4243d69e54717f3811d94d.png)